Mar

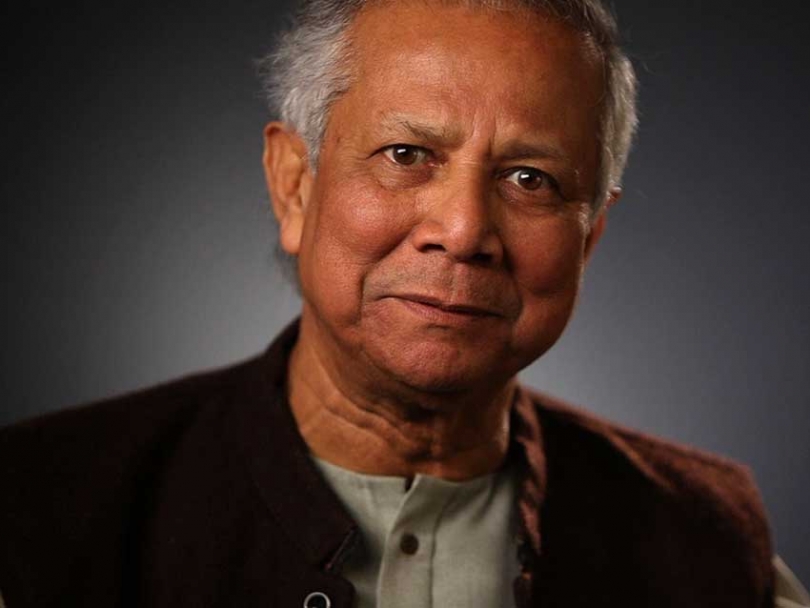

Recently the Ottawa Citizen reprinted published an article titled “Nobel winner Professor Yunus defies ouster call”. The article mentioned that supporters of Prof. Muhammad Yunus in the West were deeply concerned by what they saw as politicized attempt by the government of Bangladesh to remove him from Grameen Bank which he founded.

The nation's central bank, winch holds a minority stake in Grameen, announced last week that Prof. Yunus, 70, had been removed as managing director, claiming he violated the country's retirement laws. Prof. Yunus appealed to have his sacking notice quashed but a Bangladeshi high court has upheld the government's dismissal of the Nobel laureate from the bank he founded 30 years ago.

While the news of the dismissal of the microfinance pioneer was picked up by all the media in the West, a documentary shown on Norwegian national television accusing Prof. Yunus of accused of diverting US$ 100 Million aid never got the same coverage.

New documents made public by investigative journalist and documentary film maker Tom Heinemann in his controversial documentary on microfinance titled Caught in Micro Debt allege that the founder of Grameen Bank diverting development aid money from foreign countries into For-Profit ventures more than 10 years ago.

"Almost all the loan takers interviewed told the same story. Each one had multiple loans in various micro-credit banks and organisations and had had a hard time trying to pay back their loans. Some had sold their houses, others had their tin-sheets pulled off their houses to cover the weekly payments.” ”“ Tom Heinemann, filmmaker

Mr. Heinemann also revealed that Prof. Yunus refused to speak to him during the making of the documentary despite repeated attempts to get his version of the story.

The documentary also looks at the effectiveness of Grameen, and unsurprisingly concludes that it has had little impact on poverty. The film features interviews with academics and experts from Bangladesh and elsewhere. In one segment Mr. Heinemann visits the home of the celebrated original Grameen loan-taker - Sufiya Begum of Jobra Village. He finds out that she died in poverty and her daughters are beggars.

The film crew also travelled several times to Bangladesh and visited some of the most significant villages in the history of Grameen Bank. The crew met poor people who have gained nothing but more debt due to micro credit.

Mr. Heinemann says, "Almost all the loan takers interviewed told the same story. Each one had multiple loans in various micro-credit banks and organisations and had had a hard time trying to pay back their loans. Some had sold their houses, others had their tin-sheets pulled off their houses to cover the weekly payments.”

The film also interviews a number of leading social scientists and researchers who, for years, have questioned the “big success” of micro-credit. In fact, renowned social scientists, such as David Roodman, Jonathan Morduch, Thomas Dichter and Milford Bateman, agree on one thing: after 35 years of micro-credit there is no evidence that micro-credit lifts millions out of poverty.”

Dr Qazi Kholiquzzaman Ahmad, chairman of PKSF, a body that monitors microfinance, describes micro-credit as a “death trap” for the poor. His organization's own survey of 2,500 borrowers (99 per cent of them women) concluded that microfinance had been grossly oversold. His study revealed that the effective rate of interest charged by microfinance institutions, including the Grameen Bank, turns out to be a high as 30 to 45 percent.

Every time practices at Grameen Bank are scrutinized, uncomfortable stories emerge. Far from alleviating poverty and improving the lives of its borrowers, microfinance has caused hardship and a cycle of debt.

This article was produced exclusively for Muslim Link and should not be copied without prior permission from the site. For permission, please write to info@muslimlink.ca.