Jun

10 Principles of Successful Halal Investing in Volatile Markets

Written by Sameer AzamIn this time of global economic uncertainty, being an investor is stressful. If you have a halal portfolio, you may even feel the ups and downs of the stock market even more than conventional investors. This is because a Shariah compliant portfolio would exclude interest-based investments like GICs (Guaranteed Income Certificates) and bonds. These investments provide predictable incomes and don't change in value the same way stocks do. Without such fixed income investments to mitigate risk, investors with halal portfolios are particularly sensitive to stock market volatility.

Market volatility is a normal part of investing. The challenge is dealing with our emotions during these turbulent times. Should we sell and cut our losses? Should we buy? If we hold on, are we going to gain or lose in the long run? The decisions we make in these volatile times can make the difference between success and failure as an investor.

Fortunately, we're not alone in this. The market has gone through ups and downs before and we can benefit from the experience of the thousands of investors who have been through rough patches like these. These 10 principles can help you navigate through market volatility and achieve your long-term financial goals.

1. Stay calm and invest on

When the markets are particularly volatile, there’s a natural tendency for investors to move into safer investments like cash, hoping to avoid further losses, and wait until the markets recover. But unfortunately it’s nearly impossible to predict when the markets will recover. As a result, investors may miss out on the eventual recovery, which can negatively affect their long-term investment goals. The investor who stays invested tends to do better than the investor who bails out and misses even some of the recovery.

2. Avoid market timing

On a related note, some investors try to improve their returns by attempting to “time” the market – selling right before the markets go down, then buying right before they go up again. In theory, this sounds great. But in practice, it rarely works, simply because it’s so difficult to predict when the markets will go up or down. Unfortunately, that doesn’t stop investors from trying, which is why the “average investor” tends to under-perform virtually every asset class.

As they say, "time in the market is better than timing the market". It's better to invest and stay invested rather than try to predict the best times to buy and sell.

3. Maintain your sense of perspective

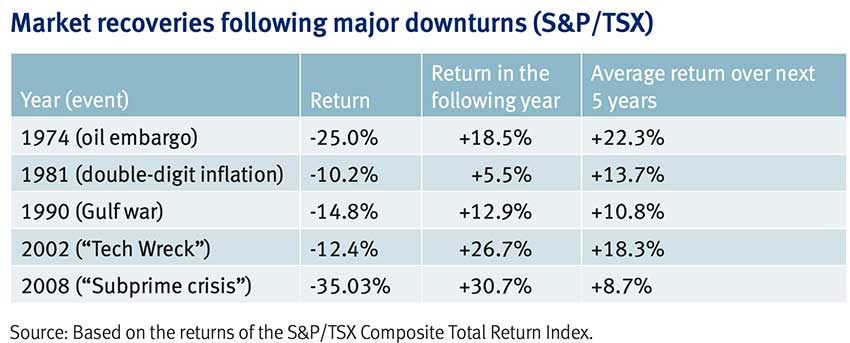

Unquestionably, stock market downturns can be painful, especially when you’re in the middle of one. It’s not always easy, but it’s important to remember that downturns have happened before – and will happen again – and that historically, as the table above shows, the markets have always recovered and reached new highs.

4. Reassess your comfort level with risk

It’s one thing to say you are comfortable with a higher level of risk when the markets are only going up, and another thing when the markets are volatile. If you are finding it difficult to sleep at night because of market volatility, then it might be time to consider how much risk you are truly comfortable taking with your investments.

5. Stay diversified

Diversifying your investments is a proven way to reduce market volatility. It involves including a certain mix of stocks, Real Estate Investment Trusts (REITs), sukuk (halal bonds), precious metals and cash in your investment portfolio, as well as investments representing different industry sectors or geographic areas. At any given time, one type of investment may do better than another. So by having investments that are somewhat uncorrelated and will likely move in different directions, you can offset weaker performers with stronger performers, reducing volatility. It can be difficult to determine exactly when one type of investment will do better than another, which is why it makes sense to stay diversified.

6. Look for opportunities

“Summer sale! Prices slashed!” When it’s a retail store saying those words, it’s usually a good thing. Yet when it’s the stock markets, people often have the opposite reaction. When prices drop, they sell instead of buy. But when the stock markets go down, it can be fairly indiscriminate: both good and bad stocks can be caught up in the sell-off. What that means is, during a market downturn, there can be some high-quality stocks, likely to be among the first to bounce back, available at temporarily reduced prices.

Keep in mind that you don't want to buy something just because of its price. As Warren Buffet said, "It is far better to buy a wonderful company at a fair price than a fair company at a wonderful price." A market downturn may provide an opportunity to buy a wonderful company at a wonderful price.

7. Regularly re-balance

How you diversify your portfolio between different investments plays an important role in how much volatility you can expect. In general, if you include more stocks in your portfolio, you will experience greater volatility, but also greater long-term growth potential. Conversely, if you include more cash or sukuk, you will experience lower volatility, but also lower growth potential.

Everyone has an ideal balance, based on factors such as:

- How long you have to invest

- How much growth you need

- How much risk you are willing to take

But over time, market fluctuations can cause the balance to shift in your portfolio, as one asset class outperforms another and eventually represents a greater percentage of your portfolio than you had originally intended. As a result, it makes sense to regularly re-balance your portfolio, to get back to your ideal balance.

For example, if you wanted to keep 50% stocks and 50% cash, and your stocks grow in value so that they make up 60% of your portfolio, you can re-balance by selling some of your stocks so you have that 50-50 balance again.

8. Stay focused on the long term

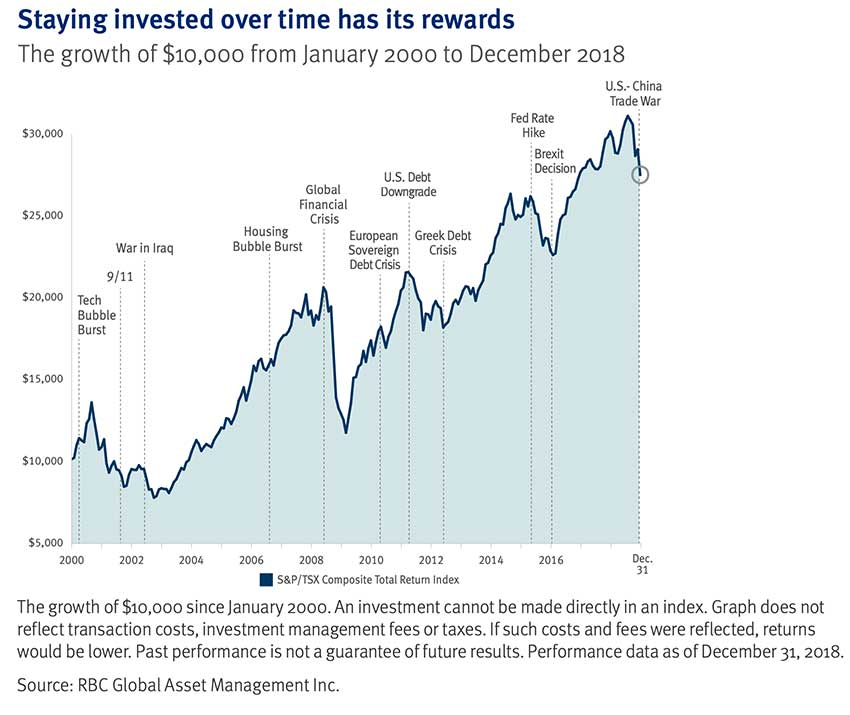

Markets may go down in the short term, often in response to a global economic crisis, but over the longer term they tend to go up.

9. Put time on your side

In the short term, volatility can seem like the roller coaster ride at your local amusement park. But over time, volatility smooths out. And the longer you have to invest, the more it tends to smooth out.

Again, "time in the market is better than timing the market"

10. Review your portfolio

Although market volatility might make you want to hide your head in the sand and not think about your investments, this is actually a good time to take a closer look at your portfolio. Part of maintaining a halal portfolio involves checking that the companies you invest in are still engaged in halal activities and that they're not carrying too much debt. So far this year, a halal, socially responsible portfolio has actually held up better relative to a conventional portfolio because of more weight in healthcare and technology.

Avoiding companies with high debt also makes good financial sense in these volatile times. A recent New York Times article explains how in recent years, some companies have taken on debt to buy their own stock and prop up their share prices. Now that lenders feel more uncertain about the economy, these companies have to pay higher interest rates to service this debt and they've struggled to get more credit. The article shows how companies with weak balance sheets suffered more losses in March than companies with strong balance sheets. By screening them out of your portfolio, the Shariah compliance filters help keep your investments more financially sound.

*******

Sameer Azam is an Investment Advisor at RBC Dominion Securities. His expertise includes investment and retirement planning, tax minimization planning, halal and socially responsible investing, estate planning and charitable giving structuring.

To learn more more about the investment process click here

DISCLAIMER

The above information is presented on the understanding that it is for education and information purposes only. The author has not been retained to provide legal, taxation, accounting or other professional advice.

Any strategies, advice and technical content in this presentation are provided as general guidance, based on information that we believe to be accurate, but we cannot guarantee its accuracy or completeness.

Individuals should consult with a professional advisor to determine the suitability of the information and examples contained in this presentation before acting upon them. This will ensure that your own circumstances have been considered properly, and that action is taken on the latest available information. Market conditions, tax rules and other investment factors are subject to change. Past performance is not a guarantee of future results.

This article was produced exclusively for Muslim Link and should not be copied without prior permission from the site. For permission, please write to info@muslimlink.ca.